The Average Car Loan Is Now 70 Months! With 0% Becoming The Norm How Long Until 84?

No one is buying new cars anymore, but many of those that did in March financed a scarily large amount of their purchase, in addition to stretching repayment over an average of nearly six years. This isn’t great!

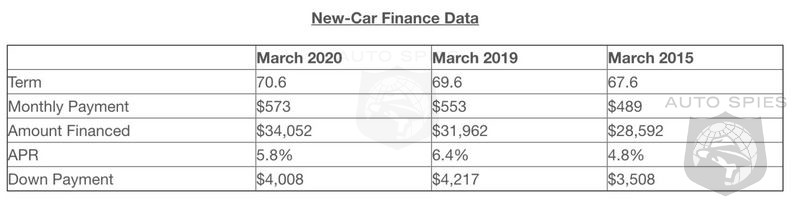

Those two nuggets are in a new report from Edmunds, which analyzed its own data and made this startling graph. Edmunds says it’s the first time loan terms have averaged over 70 months in a single month.

Read Article

Copyright 2026 AutoSpies.com, LLC