MANY Experts Say Tesla Stock Is OVERVALUED. Are They RIGHT Or Will Elon And Stockholders Who Bought Under $600 On The Latest Dip Have The LAST LAUGH?

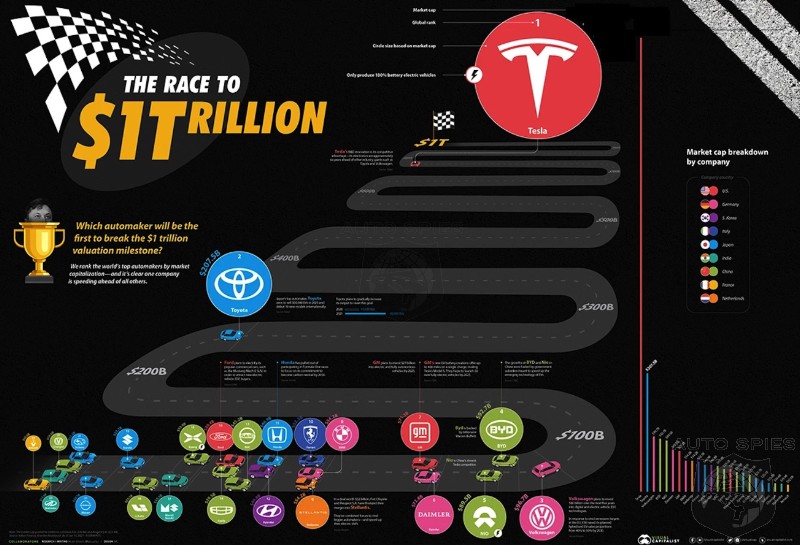

Tesla’s position as the world’s most valuable automaker is deeply puzzling (and infuriating) to many auto industry and stock market observers. How can it be that a comparatively small company, that sells a tiny fraction of the number of vehicles produced by industry giants such as Toyota and the Volkswagen Group, has a stock market valuation greater than those two combined?

To Tesla’s detractors, the EV-maker’s high-flying stock price must be due to unrealistic media hype, or perhaps it’s simply proof that the world has finally gone mad. However, to those who take a broader view of history, the explanation is simple. Stock prices never reflect a company’s present situation—they are based on investors’ evaluation of a company’s future prospects. It’s now clear that the future of automobiles is electric, and when it comes to electric vehicles, Tesla is the undisputed leader.

Source: Evanex

Spies, are the experts RIGHT? Or will Elon and those who bought under $600 on the latest dip (full disclosure, 001 dipped into Tesla at $570) have the last laugh?

Infographic: (Visual Capitalist)

Copyright 2026 AutoSpies.com, LLC