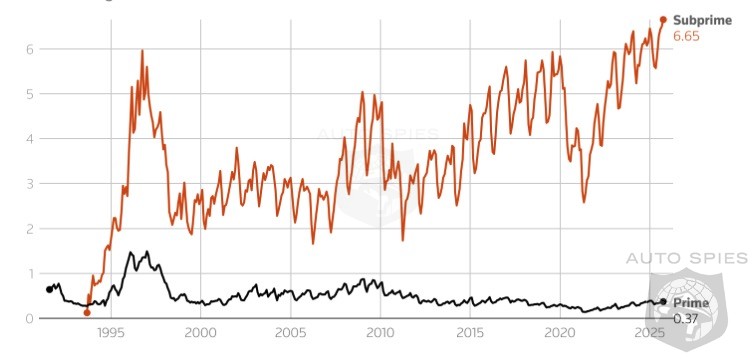

Subprime Borrowers Are Defaulting On Car Loans At Record Levels

The share of subprime borrowers at least 60 days behind on their auto loans rose to 6.65% in October, the highest level on record, according to Fitch Ratings data going back to the early 1990s.

PrimaLend, which serves the "buy-here-pay-here" auto financing market — where dealers sell and directly finance vehicles for customers with poor or limited credit — filed for bankruptcy protection last month.

Tricolor, which sold cars and provided auto loans mostly to low-income Hispanic communities in the Southwestern United States, also filed for bankruptcy in September.

Read Article

Copyright 2026 AutoSpies.com, LLC