Overall customer experience satisfaction among new energy vehicle (NEV) owners is down 26 points year over year to 770 (on a 1,000-point scale), according to the J.D. Power China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) Study,SM released today. While automakers continue to introduce NEVs and take more market share, the gap between customers' expectations and their subsequent experiences has expanded and satisfaction has declined.

The study utilizes the CXVI to evaluate the experience of NEV owners between two and 12 months of ownership. Index scores are based on evaluations of different customer groups on a variety of measures at three NEV customer experience stages: purchase, usage and after-sales service. The study focuses on providing the automotive industry with specific action guidelines for satisfying emotional needs of customers in various scenarios and is designed to provide advisement to continuously build a more efficient and holistic customer-oriented experience.

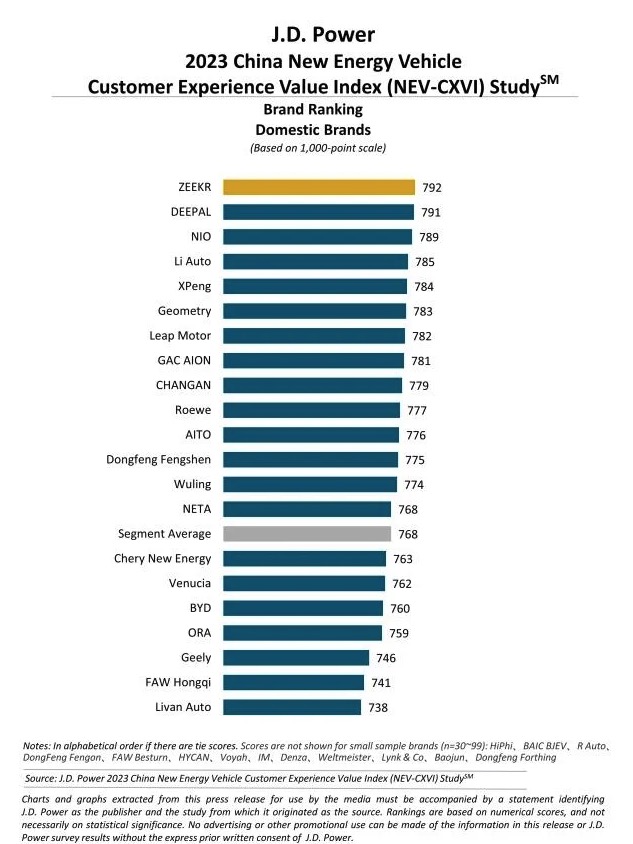

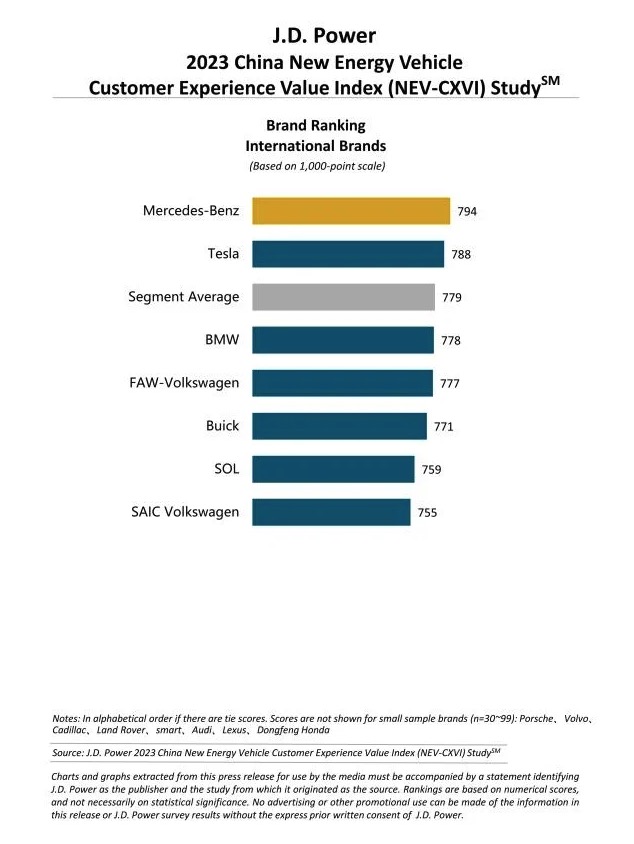

The overall CXVI score for Chinese domestic brands in 2023 is 768, down 27 points from 795 in 2022, while the index score for international brands is 779, which is 23 points lower than the score in 2022.

The study also finds that the usage experience stage (775) is the peak of the entire ownership experience, while purchase experience scores 764, ranking lowest among the three stages. In the purchasing experience stage, the purchase negotiation–specifically unclear price, terms or benefits–ranks the lowest with a score of 758.

“Previously, satisfaction scores were more of a reflection of service quality” said Ann Xie, general manager of the digital retail consulting practice at J.D. Power China. “Now we find that Increased satisfaction leads to more referrals, which brings more sales leads and orders to increase profitability.”

Following are additional findings of the 2023 study:

Direct sale brings a better user experience: The CXVI score for direct-sale brands is 787, which is significantly higher than for the dealership brands (771) and mixed-sale brands (761). The direct-sale brands have advantages in both the NEV purchase and usage stages because of price clarity and professional instruction. However, in the after-sales service stage, the mixed-sale brands score 783, which is 3 points higher than the direct-sale brands, because the mixed-sale brands meet the basic needs better, such as convenience and repair.

Satisfaction higher among first-time purchasers for after-sales service: Service satisfaction among first-time purchasers is 774, significantly higher than that of repurchasers (759) and additional purchasers (754). Additionally, the experience of first-time purchasers for service initiation, service process and service quality are better than that of repurchasers and additional purchasers.

Owners with NEVs in the price range of 200,000-300,000 yuan have higher recommendation intentions: Slightly more than one-third (35%) of owners of NEVs with a purchase price of 200,000 to 300,000 yuan are willing to share comments on their vehicle and service with others, which is a higher percentage than among owners of NEVs in the range of 100,000 to 200,000 yuan (30%) and more than 300,000 yuan (31%). Additionally, brands with high NEV-CXVI scores (higher than 775), the average Net Promoter Score[1] reaches 35, and the NPS of brands with low NEV-CXVI scores (below 759) is 19.

Highest-Ranked Brands

ZEEKR ranks highest in customer experience value among Chinese brands with a score of 792. DEEPAL (791) ranks second and NIO (789) ranks third.

Mercedes-Benz ranks highest in customer experience value among international brands with a score of 794. Tesla (788) ranks second.

The 2023 study is based on responses from 5,059 new energy vehicle owners who purchased their vehicle between April 2022 and March 2023. The study includes 49 brands and was fielded in April-May 2023 in 81 major cities across China.

The 2023 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) Study measures the purchase stage across five categories (in order of importance): delivery (21%); purchase plan (19%); customer follow-up (19%); product experience (15%); information collection (14%); and showroom experience (13%).The measures for the usage stage are (in order of importance): energy service (40%); customer service (31%) and customer equity (29%); and the measures for the service stage include service initiation (35%); service quality (35%) and service process (30%).