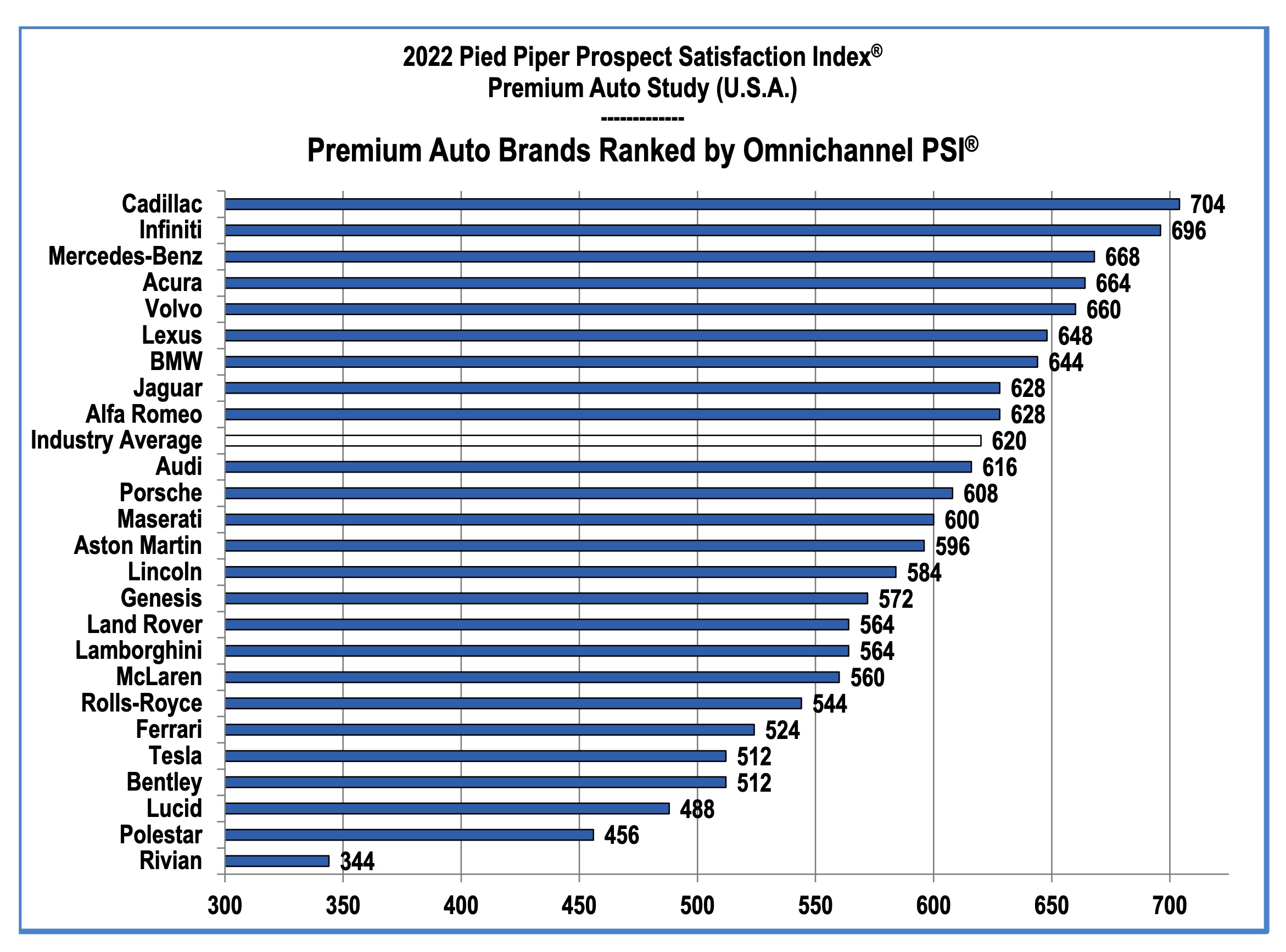

Cadillac was ranked highest in a recent measurement of how effectively premium brands and dealers helped both website and in-person vehicle shoppers. In the 2022 Pied Piper Prospect Satisfaction Index® (PSI®) Premium Auto Study released today, Infiniti and Mercedes-Benz were ranked second and third of the 25 brands measured.

The study also measured new electric-vehicle brands, and found that their omnichannel shopping experiences significantly trailed the industry average for premium brands. Using Pied Piper’s PSI process, which ties mystery shopping measurement to customer helpfulness and sales best practices, the 2022 PSI Premium Auto Study measured customers’ shopping experience, starting with responsiveness to website customer inquiries, and continuing when customers visited retailers in-person.

“Nearly all customers today start their car-shopping online. But most shoppers also still prefer to experience and evaluate a vehicle in person, if given the opportunity,” said Fran O’Hagan, CEO of Pied Piper. “Some shoppers know exactly what they want, but most still have questions or want to experience a test drive. Brands most helpful to both types of shoppers are the ones most likely to appeal long-term to all customers.”

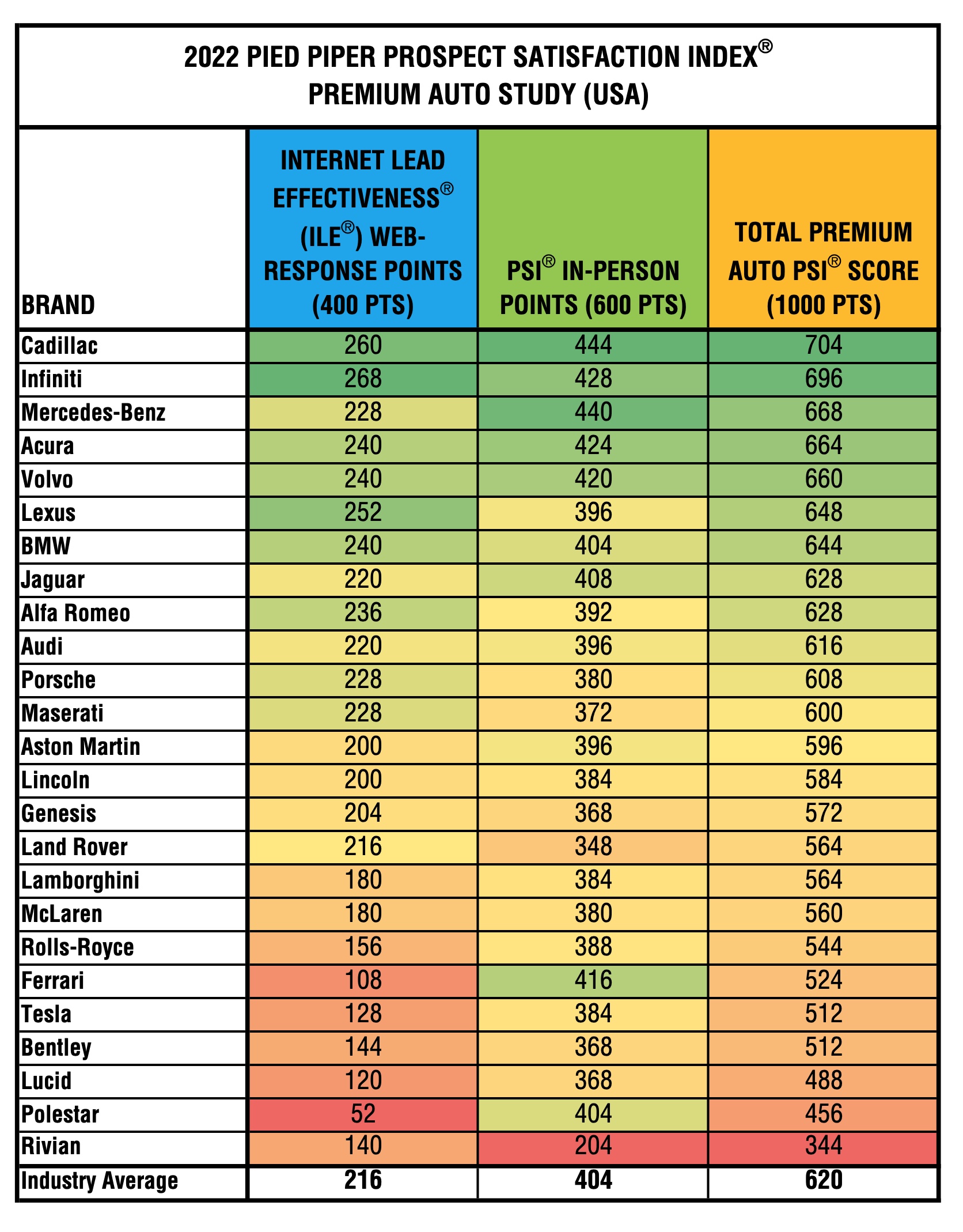

Measurement of responsiveness to website customer inquiries was based upon 22 best-practice behaviors, while effectiveness of shopping in-person was based upon more than 50 best-practice behaviors. Overall PSI rankings by brand were calculated using a 1,000 point scale, with 40% of the overall score based upon responsiveness to website customer inquiries and 60% based upon effectiveness of the in-person experience.

The 25 premium brands were evaluated between July 2021 and June 2022, using 1,657 measurements of response to website customer inquiries, and 1,096 measurements of the in-person sales experience. Note that inventory – or lack thereof – does not enter into the equation. Pied Piper PSI in-person scoring does not penalize a dealership that does not have an appropriate vehicle present at the dealership – measurements that cannot happen are recorded as “N/A.”

This year’s study was the first time several new electric-vehicle brands – Lucid, Polestar, and Rivian – were measured. Including Tesla, these brands interact with customers primarily online and have comparably few retail locations. Lucid and Tesla own and control all of their retail locations, while Rivian has a direct-to-consumer delivery model with no showrooms to date. Polestar follows the traditional franchised independent dealer approach.

Lucid, Rivian and Tesla also handle most on-line customer interaction centrally rather than through individual retail locations. This centralized ownership and control means that the brands are able to structure the sales process steps to be followed by their employees, both online and in-person. The study measured whether the customer sales experience for these brands was well-defined and consistent from customer to customer and location to location. The short answer: These new EV brands leave much room to improve in terms of customer handling.

“With an online focus and few retail locations, these new EV brands have a great opportunity to excel with phone, chat, and email interactions with their customers, to compensate for the customer’s lack of an in-person experience,” O’Hagan said. “However, we have found that when their customers reach out for help or with questions, they are usually met with brand reps who answer only simple, scripted questions without being proactively helpful. It’s a missed opportunity that does not currently compensate for the missing retail experience.”

As for the one established EV brand, as Tesla’s volume has grown, the shopping experience has not scaled with it. Comparing Pied Piper in-person studies completed in 2019, 2021, and 2022, where Tesla once was above-average, or even led the industry in multiple categories, it has now slipped below average in most – including its overall in-person score. In fact, Tesla’s 2019 in-person score would have placed it top of the 2022 pack, but their sales methodology has transformed more into order-taking than customer assistance.

“Tesla compares poorly today for helping website customers too,” O’Hagan said. “Tesla’s model today appears to be, ‘If you want what we sell, and require no assistance, it’s easy to order.’”

Also for the first time, the PSI study measured seven high-priced, “exotic” automotive brands: Aston Martin, Bentley, Ferrari, Lamborghini, Maserati, McLaren and Rolls-Royce. These brands pride themselves on personalized service as part of their vehicles’ elite status, but the Pied Piper study showed that each marque has a distinct definition of the term.

“There is quite a lot of variability in the performance of the exotic brands,” O’Hagan said. “For example, Ferrari dealers would be ranked highly, sixth of the 25 brands, for their customers’ in-person experience, but they are near the bottom for responding to website customer inquiries. In contrast, Maserati dealers excel at website response, but trail most of the industry for their customers’ in-dealership experience.”

Pied Piper PSI® Studies have been published annually since 2007. The 2022 Pied Piper PSI Premium Auto Study (U.S.A.) was conducted between July 2021 and June 2022 and was based upon 1,657 measurements of response to website customer inquiries, and 1,096 measurements of the in-person sales experience. As Rivian had no dealership locations, Rivian’s “in-person” measurement was carried out instead by customers contacting the brand by phone call, to give the brand an opportunity to interact in a manner similar to what would have otherwise happened in-person at a retail location.