Honda North America’s vehicles have the lowest average actual service and warranty costs for non-premium brands and are tied with Toyota Motor Corp.’s Lexus brand among premium brands, according to the inaugural We Predict DeepviewTM True Cost Report. We Predict shared the report’s results during a webinar hosted by the Automotive Press Association (APA) today.

Deepview True Cost is the first report of its kind to measure service and warranty costs compiled from actual service records. The report measures money spent by owners and manufacturers of 2021 model-year vehicles after three months on the road. It reveals which brands and models across 21 segments, including electric vehicles (EVs), have the lowest service costs.

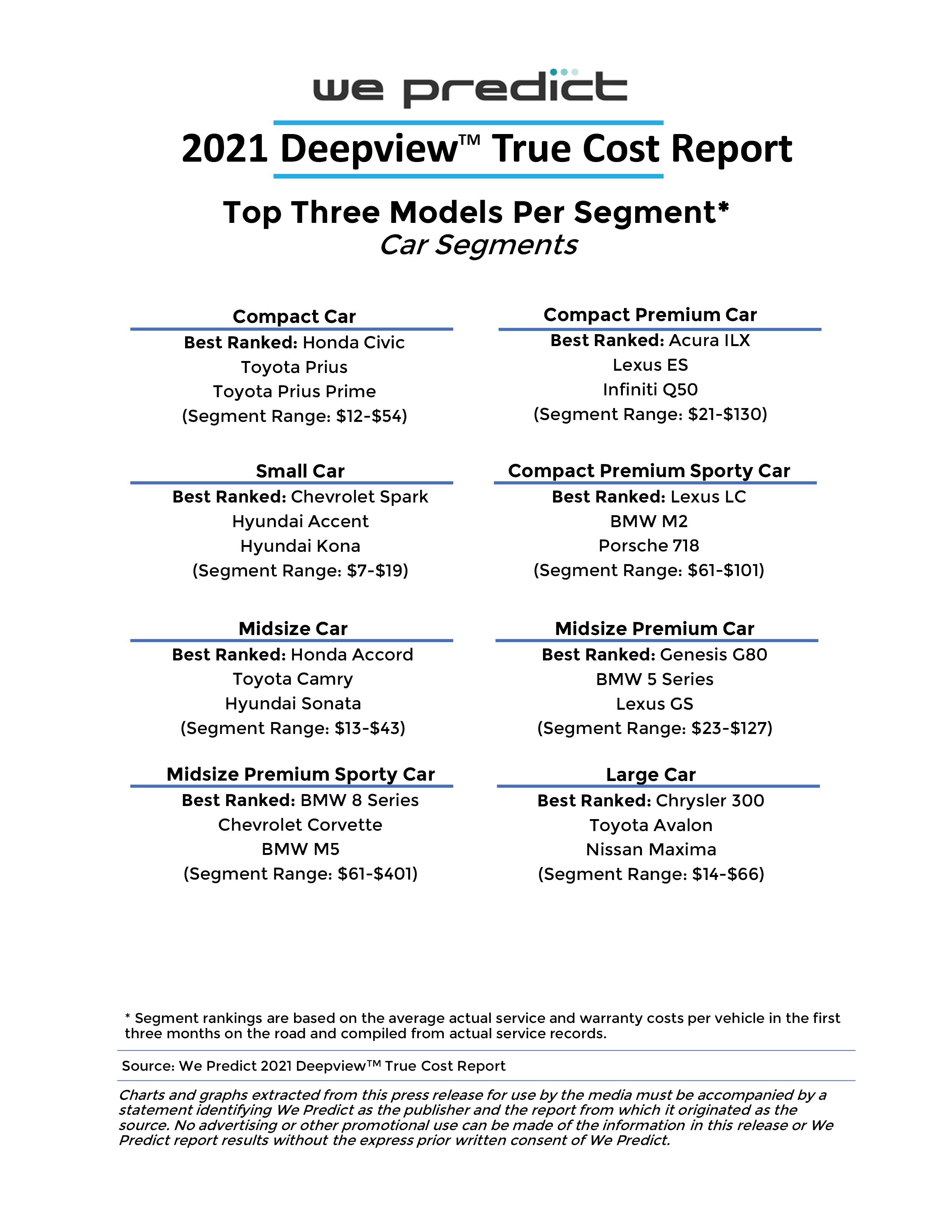

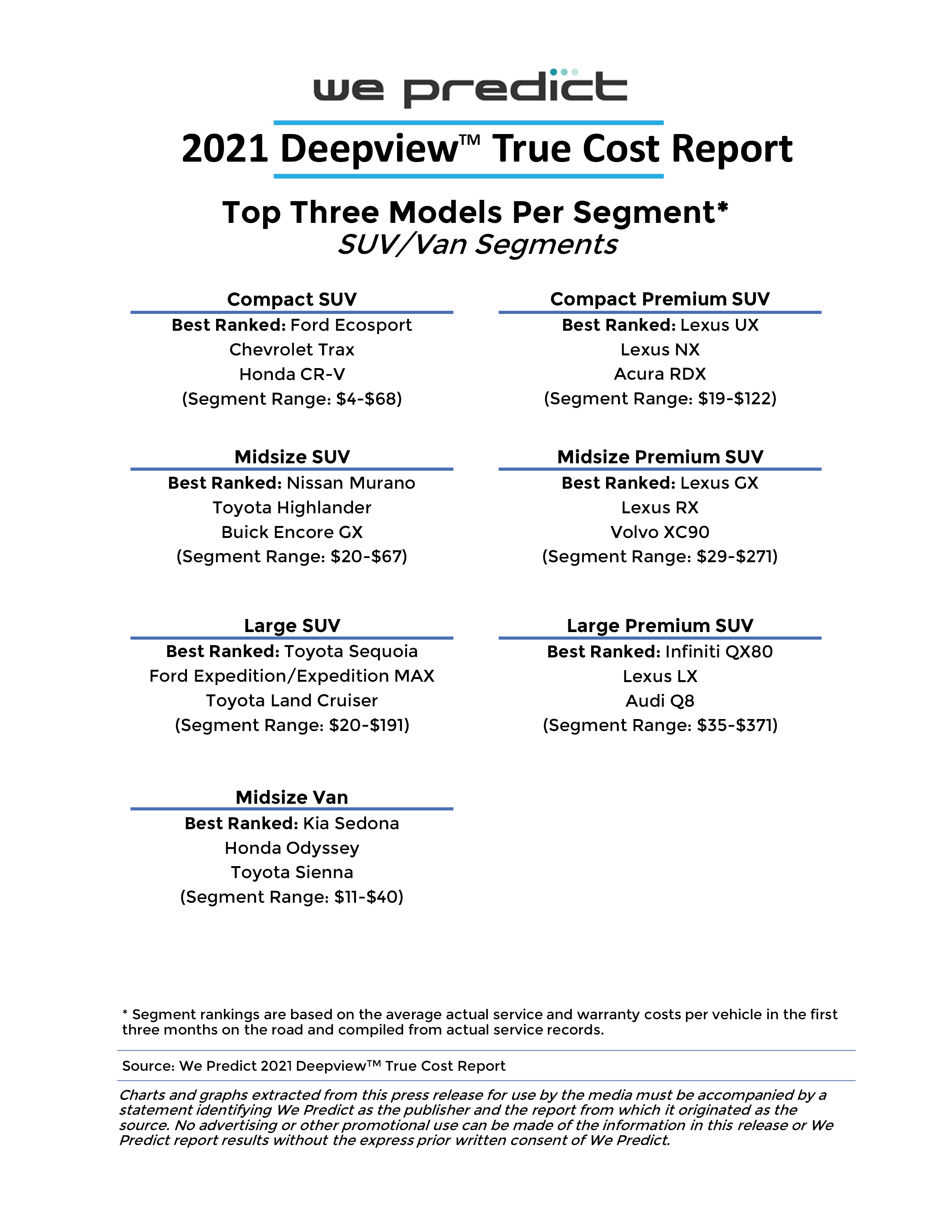

Toyota Motor Corp. leads all automotive manufacturers with four vehicles at the top of their respective segments for the lowest service and warranty costs.

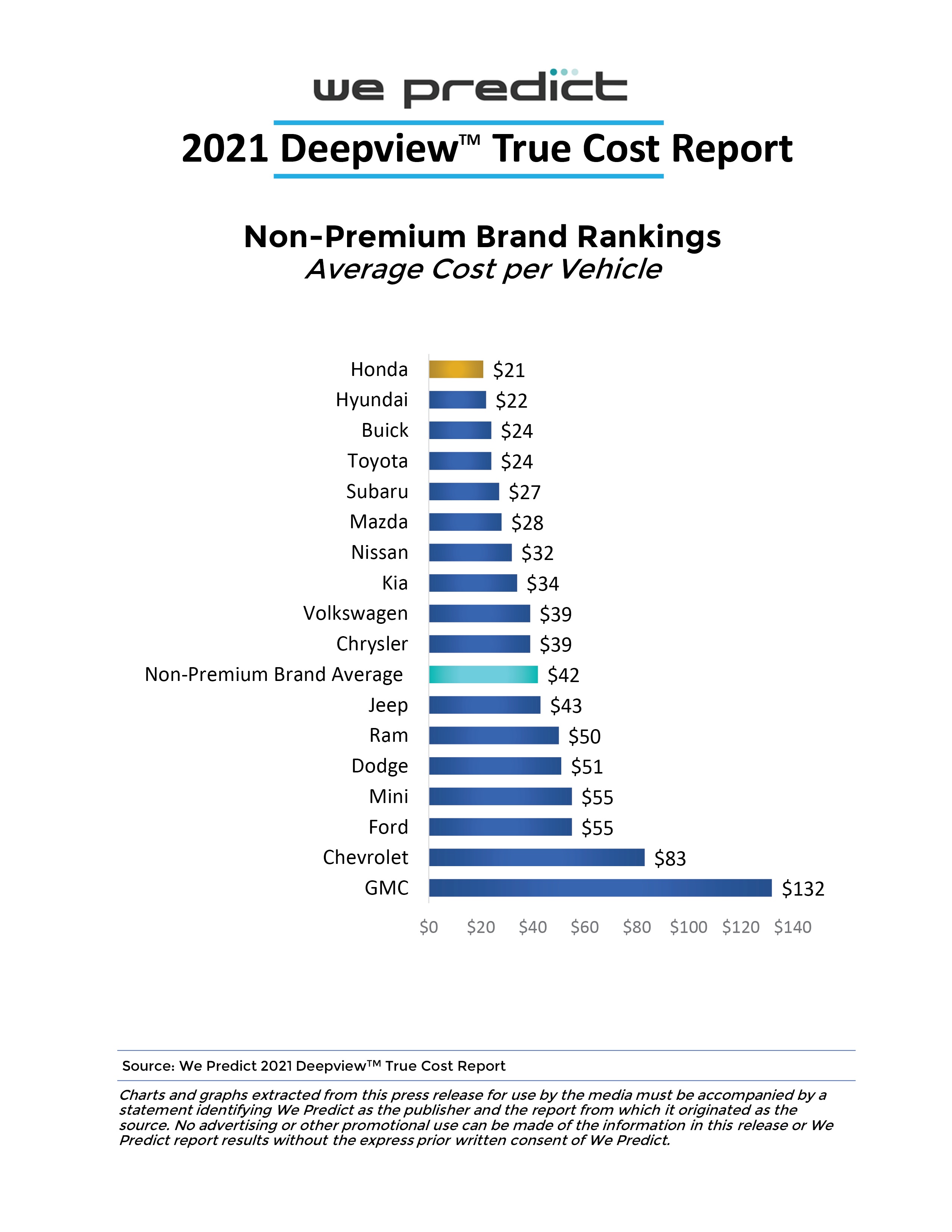

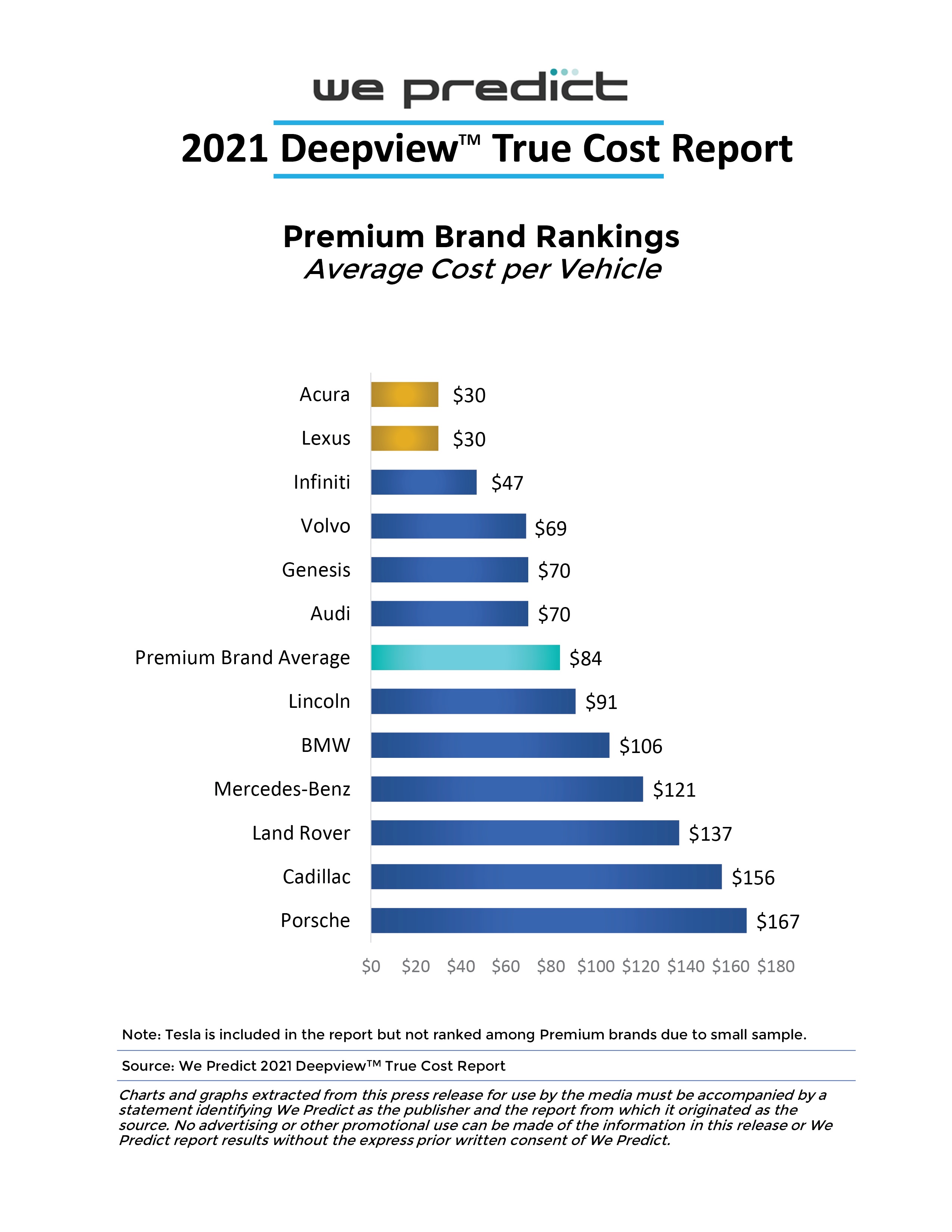

Honda ranks best among non-premium brands—with $21 in service and warranty costs—the lowest total during the first three months on the road. Acura and Lexus lead premium brands, tied with the lowest service and warranty costs of $30. The average true cost among non-premium brands after three months on the road is $42, while the premium brand average is $84.

“We’re excited to launch this first report that is based on millions of actual service records, rather than on customer-reported problems,” said James Davies, We Predict founder and CEO. “Vehicles that have low service and warranty costs at three months tend to have low costs at three years. Our predictive analytics show that problems incurred in the first three months of service often indicate how the vehicle will perform over its lifecycle. Vehicle quality doesn’t get better with age.”

Actual service costs per vehicle for the first three months of ownership range broadly from $4 to $401. Davies notes the true cost at three months on the road are multiplied by 15 at 36 months, on average, and 20 times by five years in service.

“Take the dollar figure for any model and multiply it by the number of those vehicles on the road, and then add those up for each vehicle within a brand and it very quickly grows to millions of dollars,” Davies said.

The report finds higher service and warranty costs don’t necessarily mean more problems. A vehicle can have fewer problems than others in its segment, but higher overall costs based on the nature of components repaired or replaced, as well as parts and labor expenses.

“As expected, parts for some of the luxury import brands are more expensive than parts for non-premium vehicles,” said Renee Stephens, vice president of North American operations for We Predict. “But it’s not just parts that can drive costs up. Some vehicles are simply more challenging to repair. A $50 part that takes several hours to replace can result in a repair bill in the hundreds of dollars.”

Award-Winning Models

Toyota Motor Corp.’s four segment leaders are: Lexus GX (midsize premium SUV); Lexus LC (compact premium sporty car); Lexus UX (compact premium SUV); and Toyota Sequoia (large SUV).

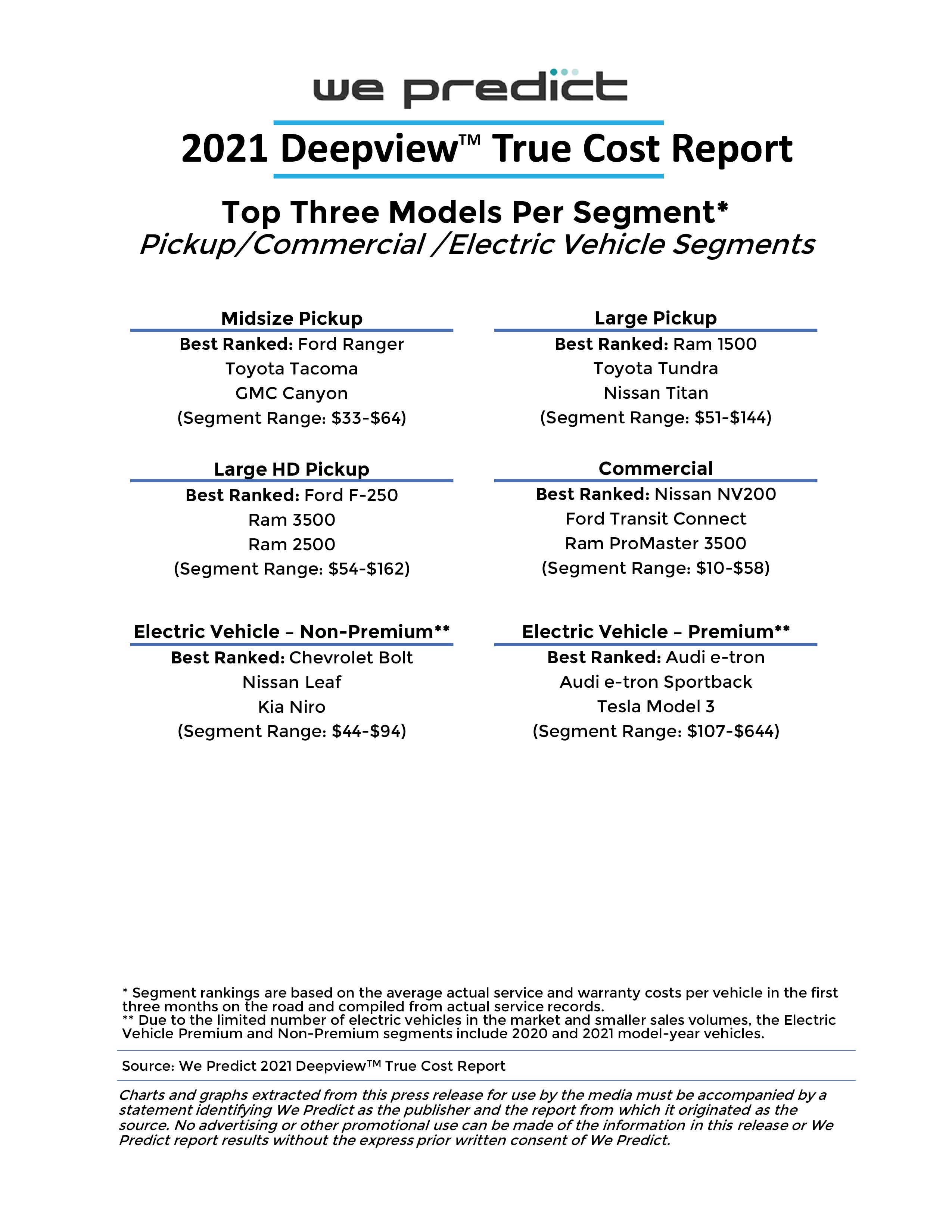

Honda North America, Nissan Motor Corp. and Ford Motor Company each have three segment-leading vehicles. Honda North America vehicles that lead their segments are the Acura ILX (compact premium car), Honda Accord (midsize car) and Honda Civic (compact car). Nissan’s highest-ranked vehicles include the Infiniti QX80 (large premium SUV), Nissan Murano (midsize SUV) and Nissan NV200 (commercial). Ford’s segment leaders are the Ford Ecosport (compact SUV), Ford F-250 (large heavy-duty pickup) and Ford Ranger (midsize pickup).

General Motors Co., Hyundai Motor Company and Stellantis each have two segment-leading models. General Motors’ award-winning models are the Chevrolet Bolt (non-premium electric vehicle) and Spark (small car). Hyundai’s top models are the Genesis G80 (midsize premium car) and Kia Sedona (midsize van). Stellantis models that top their segments are the Chrysler 300 (large car) and Ram 1500 (large pickup).

Also ranking highest in their segments are the Audi e-tron (premium electric vehicle) and BMW 8 Series (midsize premium sporty car).

Report Highlights

Other key findings in the report include:

- Repairs represent 77 percent of service visits in the first three months, while only 8 percent of service is for maintenance.

- Premium vehicle repair costs in the first three months on the road average $69, more than double the $33 average for non-premium vehicles.

- Service costs for EVs in the first three months average $123, more than twice as much as gasoline-powered vehicles ($53) and nearly triple those for hybrid vehicles ($46).

- Parts and labor costs for EVs are considerably higher than gas or hybrid vehicles. Parts costs for EVs average $65, compared with $28 for gasoline and $24 for hybrid vehicles. EV labor costs average $58, while gasoline vehicles average $25 and hybrids $22.

The report includes more than 801,000 vehicles across 306 models, with results based on 1.6 million service or repair orders that totaled more than $128 million in parts and $254 million in labor costs.

Included in the calculations are maintenance, unplanned repairs, warranty and recalls, service campaigns, diagnostics, and software updates. Items such as gas, local and state inspections, and insurance are not included.