Tesla Inc. has once again reduced the prices of several of its models, indicating that CEO Elon Musk is willing to compromise the electric carmaker's profitability in light of the potential impact of rising interest rates on consumer demand.

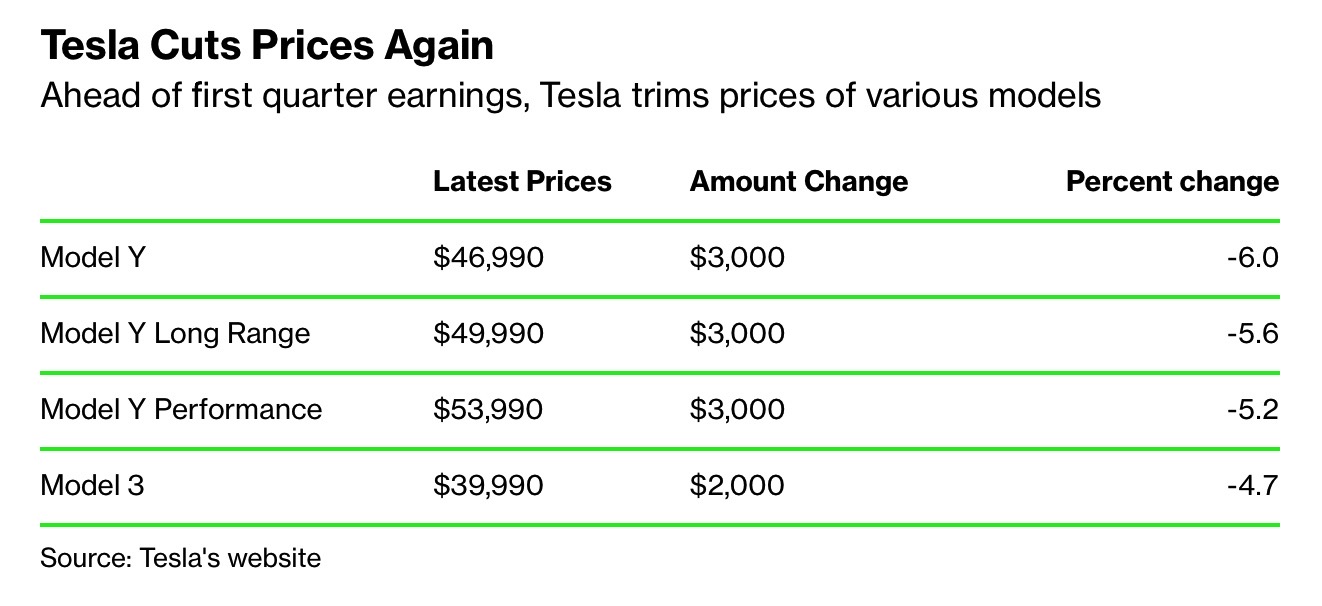

The Austin, Texas-based company has announced that it will reduce the price of its Model Y long-range all-wheel drive model by 5.6% to $49,990 and the price of the Model Y performance by 5.2% to $53,990. Additionally, the cost of a Model 3 rear-wheel drive will be cut by 4.7% to $39,990.

This is the second price cut in a month as the automaker seeks to stimulate demand after several disappointing delivery quarters. While Tesla has the benefit of higher profit margins compared to competitors like Ford and newer entrants like Rivian and Lucid, it has struggled to maintain a favorable supply-demand dynamic, with deliveries rising by only 4% in the last quarter. Despite offering discounts to the Model S and X in early March, Tesla delivered only 10,695 of those vehicles, its lowest number since Q3 2021. Investors will be eager to see the impact of these price cuts on Tesla's margins when the company reports Q1 earnings on Wednesday.